What Rules Apply to Private Foundations in Canada?

Private foundations play a crucial role in philanthropy, but the rules governing them can be complex. However, understanding the rules that govern these foundations is essential to ensure they operate effectively and fulfill their charitable mission. Let's break down the key regulations for private foundations in a straightforward and simple way.

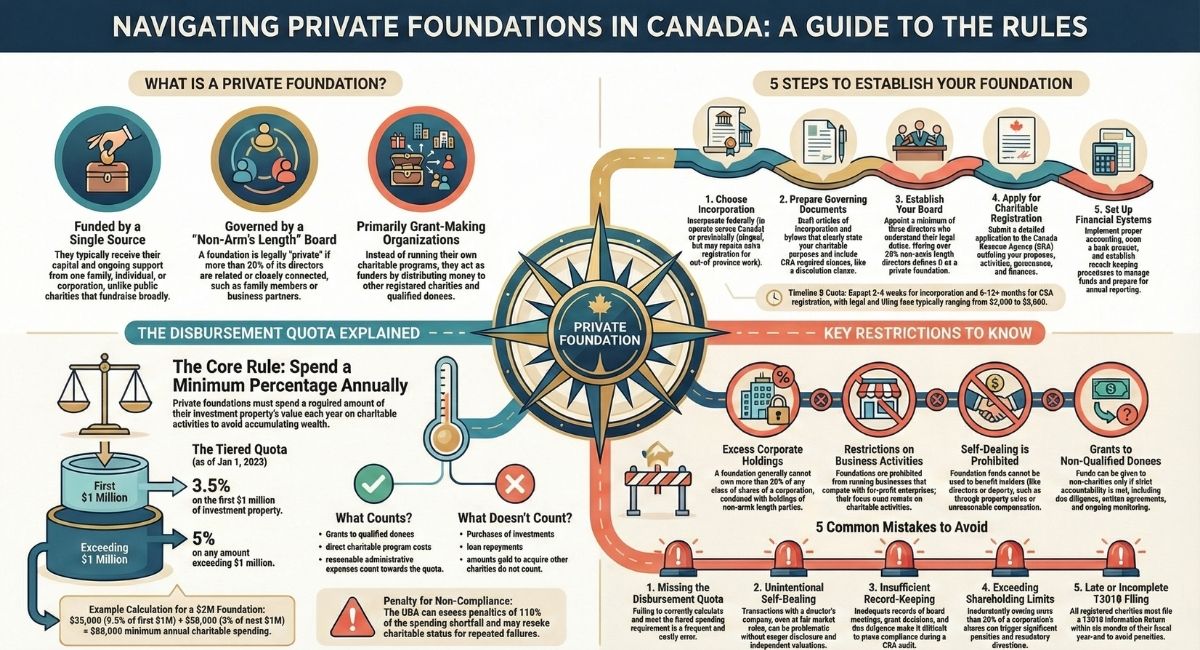

What is a Private Foundation in Canada?

A private foundation is a type of registered charity in Canada that operates differently from other charities. Here's what makes it unique:

Private foundations typically receive their funding from a single source, such as a family, an individual, or a corporation. Unlike public charities that raise money from many donors, private foundations usually have one main benefactor who provides the initial capital and ongoing support.

The board of directors in a private foundation often includes people who are not at arm's length with each other. This means they might be family members, business partners, or closely connected individuals. For a foundation to be considered "private," more than 50% of the directors, trustees, or officials must be non-arm's length to each other or to major donors.

Instead of running their own programs like food banks or shelters, private foundations primarily make grants to other qualified donees. They act as funders, distributing money to registered charities and other organizations that carry out charitable work on the ground.

How to Establish a Private Foundation in Canada

Setting up a private foundation involves several key steps. Here's what you need to know:

Step 1: Choose Your Incorporation Option

You can incorporate your foundation either federally under the Canada Not-for-profit Corporations Act or provincially under your province's nonprofit legislation. Federal incorporation allows you to operate across Canada without extra-provincial registration. Provincial incorporation is simpler but may require extra registration if you want to operate in other provinces.

Step 2: Prepare Governing Documents

You'll need articles of incorporation and bylaws that clearly state your foundation's charitable purposes. These documents must include provisions required by the CRA, such as dissolution clauses ensuring assets go to other qualified donees if the foundation winds up.

Step 3: Establish Your Board

Your foundation needs at least three directors to meet CRA requirements. Choose directors who understand their legal responsibilities and can help guide the foundation's charitable work. Remember that having more than 50% non-arm's length directors is what makes your foundation "private."

Step 4: Apply for Charitable Registration

After incorporation, you'll apply to the Canada Revenue Agency for charitable registration. The application requires detailed information about your purposes, activities, governance, and finances. The CRA reviews applications to ensure they meet the legal definition of charity.

Step 5: Set Up Financial Systems

Before you start operations, establish proper accounting systems, open a bank account, and implement record-keeping procedures. These systems help you track donations, manage investments, and prepare for annual reporting requirements.

Timeline and Costs

The incorporation process typically takes 2-4 weeks. CRA charitable registration can take 6-12 months or longer, depending on the complexity of your application. Legal and filing fees generally range from $2,000 to $5,000, plus ongoing annual costs for accounting, filing, and legal advice.

Working with a charity lawyer experienced in private foundations can help ensure your foundation is set up correctly from the start, avoiding costly mistakes and delays.

Why Are the Rules for Private Foundations Important?

A. Prevent Misuse of Funds

Private foundations are subject to regulations to prevent the misuse or mismanagement of their funds. These rules ensure that the foundation's assets are used exclusively for charitable purposes and not for personal gain or non-charitable activities. Here are some key points:

- Accountability and Transparency: Foundations must maintain detailed records of their financial transactions and activities. This helps ensure that all expenditures are properly documented and justified.

- Annual Reporting: Foundations are required to file annual returns with regulatory authorities. These returns provide a comprehensive overview of the foundation's financial activities, including donations received, grants made, and administrative expenses.

- Limitations on Self-Dealing: There are strict rules against self-dealing, which means the foundation's funds cannot be used to benefit its insiders, such as directors, officers, or substantial contributors. This includes transactions like selling property to the foundation or receiving unreasonable compensation.

B. Ensure Charitable Purpose

The primary goal of a private foundation is to serve the public good through its charitable mission. The rules and regulations help ensure that the foundation stays focused on this mission:

- Mission Alignment: All activities and expenditures must align with the foundation's stated charitable purposes. This means that the foundation cannot fund activities that do not directly support its mission.

- Program Expenses: A significant portion of the foundation's expenditures must be directed toward its charitable programs rather than administrative or fundraising costs. This ensures that the majority of resources go towards achieving the foundation's goals.

- Grantmaking Requirements: When making grants to other organizations, the foundation must conduct due diligence to ensure that the recipients will use the funds for charitable purposes. This involves reviewing the grantee's mission, financial health, and track record.

C. Tax Regulations

Private foundations are subject to various tax regulations that affect both the foundation and its donors. Understanding these tax implications is essential for proper financial planning and compliance:

- Tax-Exempt Status: Private foundations are generally exempt from federal income tax, but they must meet certain requirements to maintain this status. This includes adhering to the rules on self-dealing, payout requirements, and engaging only in non-partisan public policy activities that further their charitable purposes.

Key Rules and Regulations

1. Restrictions on Business Activities

- No Business Operations: Foundations cannot run businesses or compete with for-profit enterprises. They must focus on charitable activities and donations.

2. Control and Governance

- Major Donors and Directors: Foundations can be controlled by major donors but may also have independent directors to maintain balance and oversight.

- Example: A foundation established by a wealthy individual might have family members on the board, but it may also include independent directors to ensure impartial decision-making.

- Minimum Director Requirements: Private foundations must have at least three directors to meet CRA requirements. This ensures proper governance and decision-making oversight.

- Arm's Length Definition: The CRA considers individuals to be at arm's length if they deal with each other as independent parties without personal relationships or business connections that could influence their decisions. Family members, spouses, and business partners are typically non-arm's length.

- Board Meeting Requirements: Directors must meet regularly to review the foundation's activities, approve grants, review financial statements, and make governance decisions. Keeping detailed minutes of these meetings is essential for demonstrating proper oversight.

- Conflict of Interest Policies: Every private foundation should have a written conflict of interest policy. Directors must disclose any personal interests in transactions being considered by the foundation and abstain from voting on those matters.

- Director Liability: Directors have a legal duty to act honestly, in good faith, and in the foundation's best interests. They can be held personally liable for breaches of these duties, which is why proper governance and compliance are critical.

3. Gifts and Donations

- Qualified Donees: Foundations can give gifts to other qualified donees (e.g., public charities) or carry out their own charitable activities.

- Grants to Non-Qualified Donees: Since 2022, private foundations can make "qualifying disbursements" to non-qualified donees (grantees who are not registered charities) provided they meet specific accountability requirements. These include conducting due diligence on the grantee, entering into written agreements that specify how funds will be used, and monitoring the use of funds to ensure they further the foundation's charitable purposes.

- Fundraising: Allowed to fundraise and receive gifts from other donors.

4. Debt and Investments

- Debt Limitations: Can only incur debt for current operating expenses, purchasing investments, or managing charitable activities. Significant debt beyond these purposes is prohibited.

5. Corporate Holdings

- Excess Corporate Holdings Regime: Private foundations are subject to strict limits on corporate shareholdings. Under the Excess Corporate Holdings Regime, foundations generally cannot own more than 20% of any class of shares of a corporation (combined with holdings of non-arm's length parties). Exceeding this threshold triggers mandatory divestiture periods and significant penalties. Foundations must carefully monitor their share ownership and plan for divestiture when required to maintain compliance.

Disbursement Quota Requirements

One of the most important rules for private foundations is the disbursement quota. This requirement ensures foundations actively use their resources for charitable purposes rather than simply accumulating wealth.

What is the Disbursement Quota?

Private foundations must spend a minimum percentage of the average value of their investment property each year on charitable activities. This is called the disbursement quota. As of January 1, 2023, the disbursement quota is calculated on a tiered basis:

- 3.5% on the first $1 million of property not used in charitable activities or administration

- 5% on any amount exceeding $1 million

Investment property includes stocks, bonds, real estate held for investment purposes, and other assets that generate income.

How is it Calculated?

The CRA calculates your disbursement quota based on the average fair market value of your investment property over the previous 24 months. For example:

- If your foundation has $800,000 in investments, you must spend at least $28,000 annually (3.5% of $800,000)

- If your foundation has $2 million in investments, you must spend at least $85,000 annually (3.5% on the first $1 million = $35,000, plus 5% on the remaining $1 million = $50,000)

What Counts Toward the Quota?

Several types of spending count toward meeting your disbursement quota:

- Grants to Qualified Donees: Money given to registered charities and other qualified donees counts fully toward your quota.

- Direct Charitable Programs: If your foundation runs its own charitable programs, reasonable expenses for these activities count.

- Qualifying Disbursements to Non-Qualified Donees: Grants to non-charities can count toward your quota if they meet the requirements for qualifying disbursements, including proper due diligence, written agreements, and monitoring to ensure the funds further your charitable purposes.

- Reasonable Administrative Costs: A portion of administrative expenses related to charitable activities may count, but this is limited.

What Doesn't Count?

Certain expenditures do not count toward your disbursement quota:

- Purchases of investment property or capital assets

- Loan principal repayments

- Amounts paid to acquire other charities

- Gifts received from other registered charities that are spent in the same fiscal year

Penalties for Non-Compliance

Failing to meet your disbursement quota has serious consequences. The CRA can assess penalties equal to 110% of the shortfall amount. Repeated failures can lead to suspension or even revocation of your charitable status.

Excess Disbursements

If your foundation spends more than the required quota in a given year, you can carry forward the excess amount for up to five years. This provides flexibility if your spending varies from year to year.

Annual Filing and Compliance Requirements

Private foundations must meet several ongoing compliance obligations to maintain their charitable status.

T3010 Annual Information Return

Every registered charity, including private foundations, must file a T3010 Registered Charity Information Return each year. This comprehensive form reports your foundation's financial activities, governance, programs, and compliance with CRA rules. Learn more about Form T3010 requirements.

Filing Deadlines

You must file your T3010 return within six months after your fiscal year-end. For example, if your fiscal year ends on December 31, your return is due by June 30 of the following year. Missing this deadline can result in penalties and potential revocation of charitable status.

Public Disclosure Requirements

The CRA makes T3010 returns publicly available online. Anyone can view your foundation's financial information, governance structure, and charitable activities. This transparency helps ensure accountability in the charitable sector.

Books and Records

Private foundations must maintain detailed books and records for at least six years. These records include:

- Financial statements and accounting records

- Bank statements and cancelled cheques

- Receipts for all expenditures

- Board meeting minutes

- Grant agreements and due diligence documentation

- Donation receipts issued to donors

- Employment records if you have staff

Financial Statement Requirements

While not all small foundations require audited statements, maintaining accurate financial records is mandatory. Foundations with significant assets or revenues may need to prepare audited or reviewed financial statements depending on their governing documents and provincial requirements.

Registration Renewals

Unlike some jurisdictions, Canadian charitable registration does not expire as long as you continue filing annual returns and complying with CRA requirements. However, you must update your registration information whenever there are changes to your directors, address, or legal structure.

Tax Benefits and Restrictions

1. Donation of Publicly-Listed Securities

- Capital Gains Tax Elimination: No capital gains tax on the donation of publicly-listed securities, making it attractive for donors to contribute stocks and securities.

- Example: If someone donates $10,000 worth of publicly-listed shares to a foundation, they do not have to pay capital gains tax on the increase in value of those shares.

2. Ecologically Sensitive Land

- Capital Gains Tax: Donations of ecologically sensitive land do not receive an exemption from capital gains tax.

3. Non-Qualifying Securities

- Restrictions: Donating non-qualifying securities (e.g., certain private company shares) is subject to strict rules to prevent abuse.

4. Loanbacks and Non-Qualified Investments

- Heavy Regulation: Restrictions on loanbacks and non-qualified investments to prevent conflicts of interest and ensure charitable use of assets.

- Example: A foundation cannot lend money to its major donor or invest in a business owned by the donor without facing significant regulatory hurdles.

Common Mistakes Private Foundations Make

Learning from common mistakes helps your foundation avoid compliance problems and operate more effectively.

Mistake #1: Missing Disbursement Quota Requirements

Many foundations fail to properly calculate and meet their disbursement quota. This happens when founders don't understand the tiered structure (3.5% on the first $1 million and 5% above that) or mistakenly believe certain expenditures count when they don't. Always track your quota carefully throughout the year and plan spending accordingly.

Mistake #2: Improper Gifts to Non-Qualified Donees

Private foundations can make grants to non-charities through qualifying disbursements, but only with proper accountability measures in place. Making grants without conducting due diligence, entering into written agreements, and monitoring fund usage puts your charitable status at risk. Always document your qualifying disbursement procedures when funding non-qualified donees.

Mistake #3: Self-Dealing Without Realizing It

Board members sometimes don't recognize transactions as self-dealing. Purchasing services from a director's company, even at fair market value, can be problematic. Always disclose potential conflicts and get independent valuations for any transactions involving insiders.

Mistake #4: Poor Investment Management

Some foundations invest in prohibited investments without realizing they're non-qualified. Others fail to diversify properly or take excessive risks with charitable assets. Work with qualified investment advisors who understand the special rules applying to charitable assets.

Mistake #5: Insufficient Record-Keeping

Many foundations keep inadequate records of board meetings, grant decisions, and due diligence. If the CRA audits your foundation, poor documentation makes it difficult to demonstrate compliance. Maintain detailed records of all decisions and transactions.

Mistake #6: Ignoring Qualifying Disbursement Requirements

When making grants to non-charities, foundations must meet specific accountability requirements including due diligence, written agreements, and monitoring. Simply giving money and hoping it's used for charitable purposes isn't enough. Implement proper oversight mechanisms and documentation to ensure your grants qualify as qualifying disbursements.

Mistake #7: Unclear Charitable Purposes

Some foundations draft overly broad purposes or include non-charitable objectives in their governing documents. This creates problems during CRA reviews. Ensure your purposes are exclusively charitable and clearly drafted.

Mistake #8: Mixing Personal and Foundation Finances

Using foundation bank accounts for personal expenses, even temporarily, is a serious violation. Maintain strict separation between personal and foundation finances at all times.

Mistake #9: Late or Incomplete T3010 Filing

Rushing to complete your annual return at the deadline often results in errors or missing information. Start your T3010 preparation early each year to ensure accuracy and timely filing.

Mistake #10: Failing to Update Governing Documents

Laws change, and your foundation's governing documents may need updates to remain compliant. Older foundations incorporated before current legislation may have outdated provisions. Review your documents regularly with a charity lawyer.

Mistake #11: Exceeding Corporate Shareholding Limits

Foundations sometimes inadvertently exceed the 20% limit on corporate shareholdings, especially when they receive share donations or when share values fluctuate. Monitor your holdings regularly and have a divestiture plan in place to address excess holdings before penalties apply.

Conclusion

Understanding the rules that apply to private foundations is crucial for effective management and donation. While complex, these regulations ensure transparency and adherence to charitable missions. By adhering to these rules, private foundations can continue making a positive impact on society, ensuring their operations are both lawful and effective.

If you're establishing a private foundation or need guidance on compliance requirements, B.I.G. Charity Law Group can help. Our experienced charity lawyers provide practical legal solutions tailored to your foundation's unique needs, from charitable registration to ongoing compliance.

Contact us today at 416-488-5888 or email dov.goldberg@charitylawgroup.ca. Visit CharityLawGroup.ca or schedule a FREE consultation to discuss your private foundation needs.

Frequently Asked Questions

What is a private foundation in Canada?

A private foundation is a type of registered charity that typically receives funding from a single source (like a family or corporation), has a board with non-arm's length members, and primarily makes grants to other qualified donees rather than running its own charitable programs.

What are the rules for not-for-profits in Canada?

Nonprofits must operate exclusively for non-profit purposes, cannot distribute profits to members, must dissolve assets to similar organizations if wound up, and follow provincial/territorial incorporation laws. They may need to register federally if operating across provinces.

How do foundations work in Canada?

Foundations raise funds, invest assets, and distribute money through grants to support charitable causes. Private foundations are funded by limited sources, while public foundations raise money broadly. Both must spend a minimum percentage annually on charitable activities—as of 2023, this is 3.5% on the first $1 million and 5% on amounts exceeding $1 million.

What are the four categories of Canadian nonprofits?

Charitable organizations conduct direct charitable work like running food banks or hospitals. Public foundations raise money from the general public to make grants to other charities. Private foundations receive funding from limited sources like families or corporations to distribute grants. Non-charitable nonprofits operate for social, recreational, or community purposes without charitable status.

What are the requirements for a charity in Canada?

Must have exclusively charitable purposes (relief of poverty, advancement of education, advancement of religion, or other purposes benefiting the community), provide public benefit, be registered with Canada Revenue Agency, file annual returns, and spend required amounts on charitable activities.

What is the difference between a nonprofit and a charity in Canada?

Nonprofits operate for non-profit purposes but aren't necessarily charitable. Charities are a specific type of nonprofit with exclusively charitable purposes, CRA registration, tax-exempt status, and ability to issue tax receipts for donations. All charities are nonprofits, but not all nonprofits are charities.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)