How To Start A Foundation In Canada

Starting a foundation in Canada is a clear way to support causes that matter to you. It involves creating a registered charity that can raise funds and make grants or carry out its own charitable work.

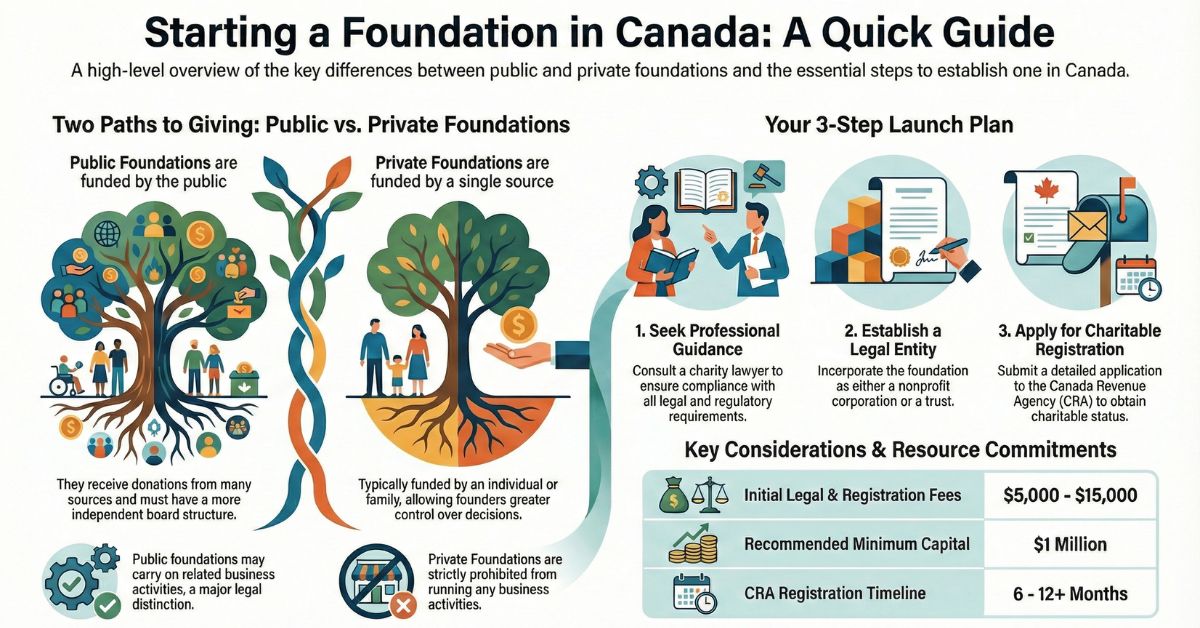

The essential steps include incorporating a legal entity, applying for charitable registration with the Canada Revenue Agency (CRA), and setting up proper governance and funding.

Foundations come in two main types: private foundations, usually funded by an individual or family, and public foundations, which rely on donations from the public. Each has different rules about funding sources, governance, and operations, but both offer tax benefits and the ability to issue official donation receipts.

This guide covers the process, including legal requirements, costs, and timelines. Understanding these details helps founders make informed choices and set up a foundation that fits their goals.

Understanding Foundations in Canada

Do you want to start a foundation in Canada? If yes, you have come to the right place! This guide will provide you with the necessary steps to establish a foundation in Canada.

What are Foundations in Canada?

Foundations in Canada are set up either as trusts or corporations with the main goal of donating funds to qualified donees or conducting their own charitable activities.

How are Private Foundations Different from Charitable Organizations?

Under the Income Tax Act, all foundations—whether public or private—are registered charities. The key distinction is not between "foundations" and "charities," but between charitable organizations and charitable foundations (which can be either public or private).

Charitable organizations typically receive donations from various sources and directly carry out their own charitable activities. Private foundations, on the other hand, are usually funded by a single individual, family, or corporation. While private foundations often focus on making grants to other qualified donees, they are fully permitted to carry out their own charitable activities if their governing documents provide for this.

Foundations in Canada play a key role in the charitable sector. They provide funding, support various causes, and follow specific legal and financial rules.

It's important to understand the types of foundations, how they operate, and what role charitable organizations play in this landscape.

Types of Foundations

In Canada, foundations are registered charities that fall into two main categories: private foundations and public foundations. Both can be set up as trusts or corporations, but their funding sources and operations differ.

Private foundations are usually funded by a single donor, family, or corporation. They focus on making grants to other qualified organizations or sometimes run their own charitable activities.

Private foundations are strictly prohibited from carrying on any business activities under the Income Tax Act. This is a major distinction from public foundations and charitable organizations, which may carry on related businesses.

Public foundations raise funds from the public, including individuals, organizations, and corporations. They often support multiple charities by granting a large portion of their income.

Public foundations generally have more donors and operate with greater public accountability.

Public vs. Private Foundations

The main difference between public and private foundations lies in their funding and governance.

Private foundations offer more control to founders but require sufficient initial funding. Public foundations depend on broad community support and follow different governance rules to maintain charitable status.

Role of Charities in the Sector

Charities in Canada include foundations and other groups that perform charitable work. Foundations mainly provide funding to these charities or run their own programs to serve public causes.

Registered charities deliver services, fund research, and support communities. Foundations help channel funds effectively and must register with the Canada Revenue Agency (CRA), which oversees compliance and grants charitable status.

Charitable registration allows foundations to issue donation receipts and receive tax benefits. This encourages philanthropy and makes it easier for individuals and corporations to support causes through foundations.

Is a Private Foundation Right for You?

Before establishing a private foundation, it's important to reflect carefully on whether this structure aligns with your goals, resources, and personal circumstances. Consider the following key questions:

1. What Are Your Motivations for Giving?

Understanding why you want to establish a foundation will help ensure it's the right choice.

Personal Altruism:

- Do you have a desire to give back to the community and society?

- Do you feel your personal wealth was earned with the support of the communities in which you live and work?

- Are you fortunate enough to make a significant and sustained gift that will benefit many others?

- Do you want to contribute to specific communities and institutions of your choosing?

The desire to give back to the community and to society is perhaps the most important reason that many philanthropists cite for their decision to engage in structured giving. Altruism is indeed a major driver of the creation of foundations.

Personal Engagement:

- Do you want to shape your gift more personally?

- Are you interested in choosing the specific projects and people you give to?

- Do you wish to influence goals and desired outcomes?

- Do you want to observe the impact of the funds and other support that you give?

- Would you like to share lessons learned and results with others?

As a long-term donor, you can be engaged in choosing the projects and people you give to, in influencing goals and desired outcomes, in observing the impact of the funds and other support that you give, and in sharing the lessons learned and results with others.

While funds can vary dramatically in size and focus, donors report that they consistently return the same rewards for those who become engaged: rich learning experiences, and a great sense of accomplishment and satisfaction. Many donors say that they work harder than they ever have before—because they want to. The more engaged they become, the more satisfying many of them find their involvement. Foundations have a way of engaging your skills, talents, experience, and knowledge very deeply.

Family Unity:

- Do you want to involve multiple family members in philanthropic activities?

- Would you like to bring together various skills, talents, and interests of family members across generations?

- Are you interested in creating a positive and engaging opportunity for the family to work together?

- Do you want to shape common values and family identity?

- Would you like to teach younger generations the values of philanthropy?

Family foundations can be rallying points for extended family members. Foundations allow several family members across generations to bring together their various skills, talents, and interests for a shared cause. A foundation structure is an excellent vehicle to teach younger generations the values of philanthropy, and other important skills, such as governance, investment management, resource allocation, project evaluation and assessment of impact.

Creating a Legacy:

- Do you want to make funding commitments that last many years?

- Are you interested in creating an enduring legacy beyond your lifetime?

- Would you like to return assistance that was given to you at another stage in life?

- Do you wish to establish a lasting philanthropic imprint on society?

Because a foundation generally makes grants from the return on its invested assets, the foundation can make funding commitments that last many years (as long as the assets remain undepleted). While there is no requirement to hold funds in perpetuity, the majority of foundations choose to grow or maintain their assets rather than spend them down in the long term. Not all donors choose to have a foundation that endures beyond their lifetime. But whether for their lifetime, or for an enduring purpose, donors create foundations to leave a lasting philanthropic imprint on society.

Risk-Taking in Philanthropy:

- Do you want the ability to spot great ideas and react quickly?

- Are you willing to take risks on unproven approaches?

- Would you like to make grants to innovative ideas without conditions?

- Do you want to make multi-year commitments?

- Are you interested in trying out new approaches?

The grantmaker in a private foundation has considerable freedom to decide which grants he or she makes individually or with family and colleagues. Many foundation donors are able to spot great ideas, react quickly, and take risks on the unproven. A grant made to an innovative idea or approach just might contribute to the next major breakthrough in cancer research, in youth mental health, or in preventing school dropout. The ability to respond quickly without conditions, to make multi-year commitments, and to try out new approaches are particularly attractive characteristics to many philanthropists.

Control Over Investments:

- Do you want control over the management of foundation assets?

- Would you prefer to manage investments directly or work with consultants?

- Do you have significant experience and expertise in asset management?

- Are you confident in your abilities to manage and grow assets in a charitable fund?

Private foundations provide you with a high degree of control over the management of the foundation assets. Foundation directors can work with investment consultants or manage the investments of the foundation directly. Individuals who choose to manage the foundation's investments often do so because they bring to the job significant experience and expertise in asset management as well as the ability to tolerate risk.

2. How Much Time and Control Do You Want?

Time Commitment:

You should decide whether you want to be personally involved in administration. Consider:

- Do you want to chair the board?

- Will you manage the foundation's portfolio, with or without the help of advisors?

- Are you directly interested in grantmaking, visiting sites, and dealing directly with grantees?

- How much time can you devote to these activities?

This level of involvement can draw on more of your time. You also need to consider your availability and interest.

Some foundation donors are not interested in a high level of personal involvement and turn over almost all management tasks to a family office or advisor. Others take on the administration as a full-time or part-time job, paid or unpaid. Yet others hire one or more staff (family or non-family) to take on some of the responsibilities.

One way that some new foundations manage their time is by accepting proposals by invitation only, rather than through open calls for proposals. You can also restrict the volume of unsolicited proposals by being open and clear about the foundation's interests and guidelines.

Realistically, it may take up to 18 months from the beginning to determine the level of time and energy required and what needs to be done.

Level of Control:

Consider what level of control you want over:

- Where funds are spent

- Personal engagement with the process of giving and recipients

- Management of invested assets

- Grant recipient selection

- Interaction with grantees

- Strategic direction

- Investment decisions

3. Do You Want Family Involvement?

Key Questions to Consider:

- Do you want family members involved in the foundation?

- Should family members sit on the board?

- What about involving younger generations?

- How will you handle relationships among siblings?

- What should be the role of in-laws?

- How will you plan for succession?

Flexibility:

The degree of family involvement depends on a number of factors and is ultimately a personal and individual choice. There are no restrictions in a private foundation on the number of family members that can be involved. Members of the family can certainly sit on the board. They are permitted to constitute a majority of the board if desired by the founders.

Important Considerations:

However, it is important to think about family size, relationships among siblings, role of in-laws, and succession planning, if more members of the family are going to have a sustained involvement.

If you're going to have a lot of related family members involved, set conflict of interest guidelines. Have some policies or a healthy discussion that is recorded for posterity for successive meetings on how personal interests should be dealt with.

It can be useful to address generational expectations from the beginning. If family members are expected to be board members, it can be helpful to sit down at the beginning and clarify collective expectations.

4. Focus and Mission

How important is it to have a particular mission?

If you already have a general idea, it is helpful to take the time to think it through and to clarify before you start giving. The more specific you can be, the more easily you will be able to frame the goals of your giving through the foundation.

A stated purpose or area of interest and/or geographic region will allow you to direct your efforts, to communicate better with potential grantees, and to define your activities.

But this depends on context and circumstance. Some foundations are more clearly focused from the beginning. Others are not, as family members pursue different goals. It may be easier to select a focus after a few years of experience in grantmaking.

Whatever the case may be, missions are constantly evolving. The point is to take the time to be as specific as possible.

How do you develop an area of interest into a purposeful grantmaking foundation?

You can:

- Consult with community organization leaders or with other foundations already active in the community

- Hold a family and/or board retreat to discuss shared values, interests, and knowledge of the community

- Talk to experts and academics in your field of potential interest to consider critical unmet needs or emerging issues

- Begin with some initial grants and reflect on experience and outcomes after a period of time

- Consider hiring a consultant on philanthropic strategy and mission

There are many useful guides and articles available to support you through this process.

5. Financial Commitment

How much capital do you need?

You don't have to be a multimillionaire to start a foundation. Indeed, the majority of private Canadian foundations have assets of less than $5 million. There is no minimum requirement for capital endowments.

However, it is recommended to commit at least $1 million to the foundation. This can be funded over several years.

Why $1 million?

Many foundations suggest that there should be enough invested capital to permit the foundation to meet an annual disbursement equal to a minimum 3.5% of the first $1 million of invested assets, and 5% on assets exceeding $1 million, without encroaching on its capital (unless this is desired by the donor).

Adding to the Endowment:

The endowment gift can be added to in subsequent years. You can contribute to the endowment, and so can family members and friends.

Types of Contributions:

Private foundations are generally funded by personal, family, or business assets. Contributions can include:

- Cash

- Publicly-traded securities

- Life insurance proceeds

- Registered retirement plans

- Other assets (subject to specific rules)

6. Do You Want to Be Part of a Foundation Network?

You should consider whether you want to be part of a foundation network and perhaps collaborate with other funders. This has to do with the degree of involvement and participation you wish to have.

In many communities, there are local foundation groups that meet regularly to share information. Membership in a national network can provide you with access to other funders to share ideas and resources.

Steps to Start a Foundation in Canada

- Seek Professional Guidance: It's recommended to consult with a charity lawyer or someone with a comprehensive understanding of Canadian charity laws and regulations regarding foundations before beginning the setup process. This will help ensure that you comply with all legal requirements and regulations and avoid any potential legal issues in the future.

- Understand Legal Obligations: All foundations in Canada must register with the CRA Charities Directorate as charities, which entails specific advantages and responsibilities. Failure to register as a charity subjects the foundation to income tax obligations and restricts its ability to issue official donation receipts to donors.

- Establish the Foundation: Establish the foundation as a legal entity, either as a nonprofit corporation or trust, in accordance with provincial, territorial, or federal legislation.

- Apply for Charitable Registration: Apply for charitable registration through the Canada Revenue Agency (CRA). The application process involves providing comprehensive documentation and outlining the intended activities of the foundation. The CRA determines the charity's designation, whether it's a charitable organization, public foundation, or private foundation, based on factors such as funding sources, governance structure (arm's length test), and contribution patterns.

Key Legal and Regulatory Requirements

Starting a foundation in Canada requires following clear rules set by the government. Founders must create solid governing documents, define charitable purposes, and work closely with the Canada Revenue Agency (CRA) to meet all legal standards.

Legal Structure and Governing Documents

Foundations must choose the right legal structure. Most are incorporated as either a charitable organization, public foundation, or private foundation.

Incorporation provides limited liability and formal recognition under Canadian law.

Key governing documents include the letters patent or articles of incorporation. These documents explain the foundation's mission, rules for operation, and power limits. They must include legal objects that describe the foundation's charitable purposes in clear terms.

Governing documents set out the board's powers and responsibilities. They ensure compliance with CRA rules and relevant provincial laws. Independent legal advice helps avoid costly mistakes and ensures all regulatory requirements are met.

Charitable Purposes and Eligibility Criteria

To qualify as a registered charity, a foundation's purposes must fall within categories approved by the CRA. These include relief of poverty, advancement of education, advancement of religion, and other community benefits recognized by law.

Charitable purposes must be stated precisely because they define what activities the foundation can legally carry out. The CRA reviews this carefully during registration.

The foundation must operate exclusively for charitable purposes and benefit the public. Foundations that serve private interests or individuals generally won't qualify.

Meeting these criteria is essential to obtain and maintain charitable registration. This gives tax advantages and allows official fundraising.

Working with the Charities Directorate

The Charities Directorate of the CRA oversees all registered charities, including foundations. Applicants submit a detailed application through the CRA My Business Account (MyBA) portal, providing governing documents, descriptions of activities, and financial plans.

After registration, foundations file annual returns and financial statements with the Directorate. These reports show compliance with Canadian charity law.

Failure to follow CRA rules can result in penalties, loss of registration, or other sanctions. The Directorate also provides guidance and tools to help foundations meet reporting and operational standards.

Staying in regular contact with the Charities Directorate benefits a foundation's transparency and long-term stability. It helps maintain public trust and comply with Canada's charitable regulations.

Understanding Registered Charity Designations

Registered charities in Canada are categorized into three designations:

Charitable Organization:

- Established as a corporation, trust, or under a constitution.

Public Foundation:

- Established as a corporation or trust.

- More than 50% of its directors, trustees, or officials deal with each other at arm's length.

- No single person or group of non-arm's length persons controls more than 50% of the foundation's capital.

- Engages in charitable activities and may make grants to other qualified donees.

Private Foundation:

- Established as a corporation or trust.

- Conducts its charitable activities or funds other qualified donees, often other registered charities.

- Less than 50% of its directors, trustees, or officials are at arm's length, or a single person/group controls more than 50% of the capital.

- Strictly prohibited from carrying on any business activities.

Financial Considerations for Establishing a Foundation

Setting up a foundation in Canada often requires the expertise of financial or legal professionals. Costs may vary, with legal fees ranging from $5,000 to $15,000 for comprehensive assistance. We recommend obtaining 3-5 quotes from charity law firms to find the best fit for your legal needs. Additionally, incorporating a Canadian nonprofit without charity status typically incurs legal fees of $2,000 to $3,000.

Tax Implications for Nonprofits in Canada

Nonprofit organizations in Canada may be exempt from paying income tax under Section 149(1)(l) of the Income Tax Act, which provides an exemption for qualifying nonprofit organizations. However, it's important to note that organizations with purely charitable purposes must register as charities and cannot opt to simply operate as a nonprofit organization to avoid the registration process.

Section 149(1)(l) exempts qualifying nonprofit organizations from tax. However, nonprofits may become subject to tax if they fail to meet the criteria under Section 149(1)(l). Additionally, certain types of clubs (dining, recreational, or sporting) may be taxed on property income under Section 149(5) of the Income Tax Act.

Organizations seeking charitable status must apply for registration as a registered charity with the CRA.

Application and Registration Procedures

Starting a foundation in Canada involves precise steps to become a legal and tax-recognized entity. Founders must handle registration with the Canada Revenue Agency (CRA), secure charitable status, and set up a dedicated foundation account to manage finances transparently.

Registering with the CRA

The first step is to register the foundation with the Canada Revenue Agency (CRA). Applicants submit the Application to Register a Charity Under the Income Tax Act through the CRA My Business Account (MyBA) digital portal.

The application asks for detailed information about the organization's structure, including governance and decision-making processes.

Founders must prepare and include key documents such as the foundation's governing documents, a description of activities, and financial plans. The CRA uses this information to confirm that the foundation meets legal requirements.

Completing the application carefully is essential. Any missing or incorrect information may delay the process. The CRA's service standard is 6 months for simple applications and 10 to 12 months for complex applications (which foundations often are), though processing times can vary depending on CRA workload and backlogs.

Obtaining Charitable Status

Obtaining charitable status allows foundations to issue official donation receipts and receive tax benefits. Applications must show that the foundation's activities serve charitable purposes recognized by Canadian law, such as education, relief of poverty, or advancement of religion.

Once registered, the foundation must meet CRA compliance rules. This includes filing annual information returns and ensuring funds are used for stated charitable purposes.

Charitable status also means public accountability. Foundations must keep detailed records, submit reports on activities, and be transparent about governance and finances.

Foundation Account Set-Up

After registration, a separate bank account dedicated to the foundation must be established. This "foundation account" keeps all donations and expenditures separate from personal or business finances.

Using this account helps maintain clear financial records for CRA reporting and audit purposes. Many financial institutions offer accounts for nonprofits, which can include features like no monthly fees or cheque-writing privileges.

Internal controls should also be put in place. These include authorizations for expenditures and regular reconciliations. These steps build trust with donors and the CRA, ensuring funds are managed and accounted for properly.

Benefits of Establishing a Foundation

Starting a foundation in Canada offers numerous advantages, such as:

a. Promoting Positive Change: Foundations enable individuals or families to contribute to charitable causes and create a lasting impact.

b. Family Involvement: Private foundations often involve multiple family members, promoting a sense of unity and philanthropic values across generations.

c. Tax Benefits: Foundations enjoy tax advantages, including donation receipts, charitable tax credits, and exemption from income tax.

d. Control and Decision-Making: Foundation founders retain control over ownership and decision-making processes, ensuring alignment with their philanthropic vision.

Fundraising, Management, and Ongoing Compliance

Running a foundation in Canada requires careful management of fundraising, investments, and legal requirements. Staying organized helps secure funding, meet government rules, and maintain public trust.

Official Donation Receipts and Reporting

Foundations can issue official donation receipts to donors once registered with the Canada Revenue Agency (CRA) as a charity. These receipts allow donors to claim charitable tax credits on their income taxes.

The CRA requires foundations to keep accurate records of all donations and issue receipts promptly. Receipts must meet CRA standards, including the donor's name, amount donated, and the foundation's registration number.

Failing to comply with CRA rules on official donation receipts can lead to penalties or loss of charitable status. Foundations also report annually to the CRA's Charities Directorate, showing how donations were used and confirming ongoing charitable activities.

Investment and Grantmaking Practices

Foundations must follow strict rules about investing and distributing funds. The CRA requires foundations to spend at least 3.5% of the first $1 million of their assets annually on charitable activities or grants to qualified donees. For the portion of assets that exceeds $1 million, the disbursement quota rate increases to 5%. This disbursement quota has been in effect since January 1, 2023.

Foundations should set clear investment policies to balance growth and risk. Investments must align with the foundation's charitable purposes and not jeopardize its tax-exempt status.

Grantmaking decisions should be transparent and based on objective criteria. Foundations need to document how grants support charitable goals and ensure recipients are eligible under CRA guidelines.

Proper management prevents conflicts of interest and maintains donor confidence.

Annual Reporting and Transparency

Each year, foundations file a T3010 Registered Charity Information Return with the CRA. This report provides financial statements, descriptions of programs, and governance information.

Transparency is critical. Annual reports must show how funds were raised and spent. Foundations must disclose executive salaries, conflicts of interest, and fundraising costs.

The CRA monitors these reports to ensure compliance. Incomplete or late submissions risk investigations, penalties, or revocation of charitable status.

Communicating openly with donors and the public strengthens a foundation's reputation.

Conclusion

Establishing a foundation in Canada requires careful consideration, planning, and adherence to legal regulations. Seeking professional guidance, understanding legal obligations, and applying for charitable registration are crucial steps in the process. While there are financial and administrative considerations involved in setting up a foundation, the benefits of creating a lasting impact, promoting philanthropic values, and enjoying tax advantages make it a worthwhile endeavor.

Looking to start a foundation in Canada? The experienced charity lawyers at B.I.G. Charity Law Group have set up numerous foundations across Canada, for philanthropists in Toronto, Vancouver, Montreal, Ottawa, Calgary, Winnipeg, Mississauga and more. Our team has incorporated and filed foundation registration applications efficiently, with processing times varying based on application complexity and CRA workload. Our process is streamlined, and we can guide you through each step of registering your foundation. Click on the "Book a Call" link above, email us at ask@charitylawgroup.ca or call us at 416-488-5888 to start your foundation today.

Frequently Asked Questions

Starting a foundation in Canada involves legal steps, funding requirements, and registration with the Canada Revenue Agency (CRA). Founders must decide the type of foundation and understand the costs and operations involved.

How do you start a foundation in Canada?

Begin by choosing the foundation type: private or public. Next, incorporate the foundation as a trust or corporation under federal or provincial law.

Then, apply for charitable registration with the CRA through the My Business Account portal and set up governance structures. Adequate funding to meet legal requirements is essential.

What is a foundation in Canada?

A foundation is a registered charity created to support charitable causes. It can be public, receiving donations from the public, or private, mainly funded by one individual, family, or corporation.

Foundations make grants or run their own programs to fulfill their mission.

How to set up a charitable foundation in Canada

Founders must establish a legal entity and draft governing documents. Then, apply for charitable status with the CRA.

This process includes proving the foundation's purpose is charitable and meets CRA guidelines. Proper governance and funding plans are critical for approval.

How to register a foundation in Canada

Registration requires submitting an application to the CRA through the My Business Account digital portal with detailed documentation. Applicants provide information about the foundation's structure, activities, funding sources, and governance.

The CRA reviews the application to confirm it meets legal and charitable standards. Processing typically takes 6 months for simple applications and 10 to 12 months for complex applications.

How much does it cost to start a foundation?

Legal and registration fees typically range from $5,000 to $15,000. This includes incorporation costs, legal advice, and CRA application fees.

Ongoing costs like accounting and administration should also be considered before starting.

How do charitable foundations work?

Foundations collect funds and use those to support charitable activities or grant other registered charities. Private foundations mainly fund others or operate their own programs under strict rules, including a complete prohibition on business activities.

Public foundations raise money from many donors and support multiple causes.

What does a foundation do?

A foundation supports charitable causes by making grants, running programs, or both. It helps individuals, families, or communities create lasting social impact.

Foundations may also engage family members or donors in philanthropy and manage donated assets responsibly.

How to create a foundation in Canada?

Start by planning the charitable purpose of your foundation. Next, incorporate the organization.

Apply for registration with the CRA through the My Business Account portal. Make sure you follow federal or provincial laws.

Prepare to meet operational and fundraising requirements. Seek professional advice to help with the process.

Legal Sources & References

- Canada Revenue Agency - Disbursement Quota Calculation

- CRA Policy Statement CPS-019, What is a Related Business? (Section 6)

- Income Tax Act, RSC 1985, c 1 (5th Supp), Section 149.1(1)

- CRA - Register to use online services for charities

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)