Checklist of Annual Obligations under the Canada Not-for-Profit Corporations Act (NFP Act)

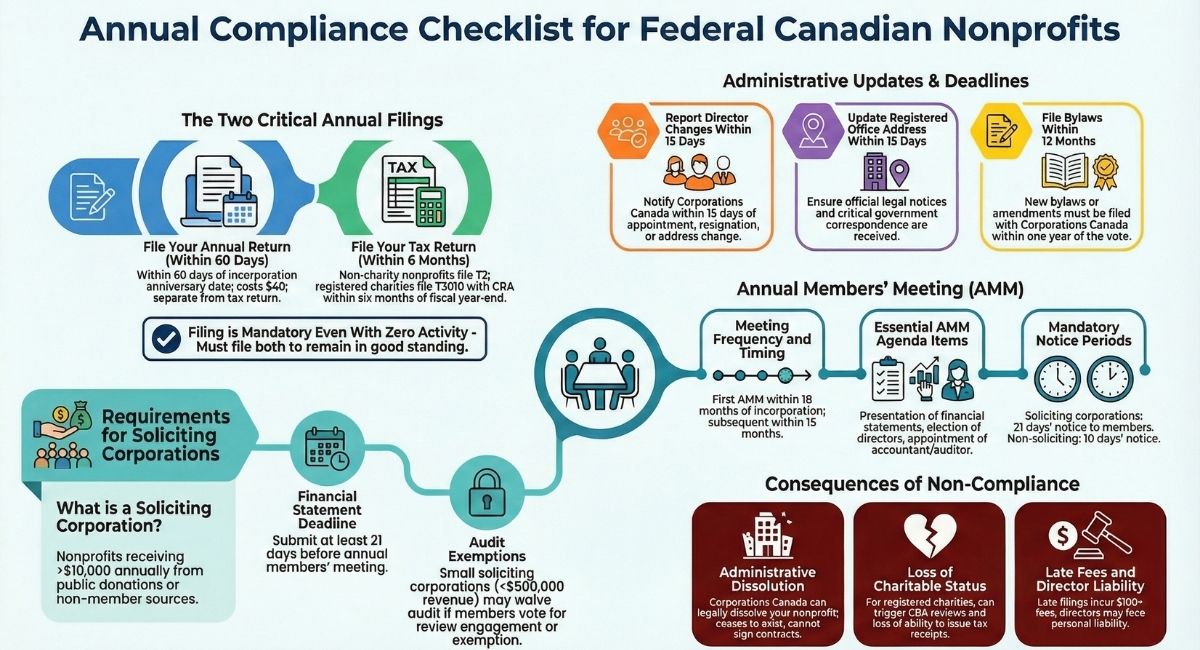

Federal nonprofits in Canada must meet several important deadlines each year to stay in good standing with Corporations Canada. The Canada Not-for-Profit Corporations Act (NFP Act) sets out specific annual obligations that apply to all federally incorporated not-for-profit organizations, whether or not they are registered charities.

Missing these deadlines can result in late fees, administrative dissolution, or loss of good standing status. For registered charities, non-compliance with corporate law obligations can also trigger concerns with the Canada Revenue Agency (CRA) and potentially affect charitable status.

This checklist covers the seven essential annual obligations under the NFP Act, along with key deadlines, filing procedures, and tips to help your organization stay compliant.

Your Annual Compliance Checklist

Q. Thank you for your assistance with incorporating our Not-for-Profit. I still can't believe you registered our NPO in just 5 hours! My question is, where do we go from here? Do you have some type of checklist for our yearly duties that we need to do to keep our non-profit in compliance with the law?

A. As a federally incorporated not-for-profit organization in Canada, you are required to fulfill several annual obligations to comply with the Canada Not-for-Profit Corporations Act (NFP Act). These include:

1. File an Annual Return

When: Within 60 days of your corporation's anniversary date (the date you were incorporated).

What it includes: The annual return reports basic corporate information including your current directors, registered office address, and confirmation that your organization is still active.

How: File online through Corporations Canada's Online Filing Centre.

Cost: The filing fee is currently $40. Late fees of $100 or more apply if you miss the deadline.

Important: This is separate from your tax return. The annual return goes to Corporations Canada, not the CRA.

2. File Your Tax Return

When: No later than six months after the end of your fiscal period. For example, if your fiscal year ends December 31, the deadline is June 30 the following year.

How: File the return as required by the Canada Revenue Agency:

- For nonprofits not registered as charities: File a T2 Corporation Income Tax Return

- For registered charities and qualified donees: File Form T3010, Registered Charity Information Return

Important: You must file even if your organization had no income or activity during the year.

3. Update Your Registered Office Address

When: Within 15 days of any address change.

Why it matters: Your registered office is where Corporations Canada and the public send official documents. An outdated address can mean you miss important notices.

4. Report Changes in Directors

When: Within 15 days of:

- A new director being appointed

- A director resigning or being removed

- A director's residential address changing

How: File the changes online through the Online Filing Centre.

Cost: No fee for updating director information.

Tip: Keep minutes from your meetings that document director elections and resignations. You'll need these dates when filing.

5. Submit Financial Statements and Accountant's Report (For Soliciting Corporations Only)

When: At least 21 days before your annual members' meeting.

Who this applies to: "Soliciting corporations" are nonprofits that receive more than $10,000 annually from fundraising or donations from people who are not members.

What you need:

- Financial statements (balance sheet, income statement, statement of changes in net assets)

- Accountant's report (review engagement or audit, depending on your bylaws and revenue level)

Exemption: Small soliciting corporations with annual revenue under $500,000 may qualify for exemptions from the audit requirement if members vote to waive it.

6. Update Your Articles

When: As soon as any major changes are approved by members, such as:

- Corporation name change

- Change in the number of directors

- Changes to membership classes or rights

- Changes to your purposes

Cost: Filing fees vary depending on the type of amendment.

7. Send Copies of Bylaws

When: Within 12 months of members confirming any new bylaws or amendments to existing bylaws.

Important: Bylaws must be confirmed by members through a vote at a members' meeting before you can file them with Corporations Canada.

Key Deadlines at a Glance

Here's a quick reference table for your annual compliance calendar:

How to File Your Annual Return: Step-by-Step

Filing your annual return is straightforward when you know what to expect. Here's the process:

Step 1: Gather Your Information

Before you begin, have ready:

- Your corporation number

- Current list of all directors with their full names and residential addresses

- Your registered office address

- Email address for correspondence

Step 2: Access the Online Filing Centre

- Go to Corporations Canada's Online Filing Centre

- Create an account or log in if you already have one

- Link your corporation to your account using your corporation number

Step 3: Complete the Annual Return Form

- The system will pre-populate some information from your last filing

- Review and update director information

- Confirm your registered office address

- Review all information carefully before submitting

Step 4: Pay and Submit

- Pay the $40 filing fee by credit card

- Submit your annual return

- Save your confirmation receipt

Time required: Most organizations complete this in 15-20 minutes.

Pro tip: Set a calendar reminder 75 days before your anniversary date so you have time to gather information and file before the 60-day deadline.

Annual Members' Meeting Requirements

In addition to filing requirements, federal nonprofits must hold annual members' meetings to maintain corporate compliance.

Timing:

- First annual meeting must be held within 18 months of incorporation

- Subsequent annual meetings must be held within 15 months of the previous annual meeting

What must be covered:

- Presentation and approval of financial statements

- Appointment or election of directors (if terms are expiring)

- Appointment of accountant or auditor (if required)

- Any other business requiring member approval

Notice requirements:

- Soliciting corporations: Must give members at least 21 days' notice

- Non-soliciting corporations: Must give members at least 10 days' notice

Quorum: Check your bylaws for quorum requirements. If you don't have quorum, you cannot conduct official business.

Records: Keep minutes of all members' meetings. These are part of your corporate records and may be requested by Corporations Canada during compliance reviews.

Common Mistakes to Avoid

Many nonprofits run into compliance issues because of these common errors:

1. Confusing the annual return with tax returns

These are separate filings going to different government departments. The annual return goes to Corporations Canada (within 60 days of your anniversary date), while tax returns go to CRA (within 6 months of fiscal year-end).

2. Missing the 15-day director change deadline

When a director joins, resigns, or changes address, you have only 15 days to report it. Many organizations forget this quick deadline and face administrative penalties.

3. Not updating the registered office address

If you move offices or change your mailing address, you must update your registered office within 15 days. Otherwise, you might miss important legal notices from Corporations Canada.

4. Forgetting to hold annual members' meetings

Even if your organization is small or inactive, you still need to hold annual members' meetings and keep minutes. Corporations Canada can request these records during compliance reviews.

5. Assuming bylaws take effect immediately

New bylaws or bylaw amendments must be confirmed by members AND filed with Corporations Canada before they're legally effective. Don't implement changes until you complete both steps.

6. Not keeping corporate records current

Federal nonprofits must maintain corporate records, including:

- Articles and bylaws

- Minutes of members' and directors' meetings

- Current director register

- Current member register (if applicable)

These records must be kept at your registered office and made available for inspection as required by law.

Consequences of Non-Compliance

Failure to meet these obligations can result in serious consequences:

For all federal nonprofits:

- Administrative dissolution by Corporations Canada

- Late filing fees and penalties

- Loss of good standing status

- Difficulty opening bank accounts or applying for grants

- Personal liability for directors in some cases

For registered charities:

- Additional compliance concerns with the CRA

- Potential revocation of charitable status under the Income Tax Act

- Inability to issue tax receipts

- Loss of access to charitable funding sources

Administrative dissolution means your corporation is legally removed from the corporate register and ceases to exist. If this happens, you'll need to apply for revival, which involves additional fees and administrative work. During the dissolution period, your organization cannot legally operate, sign contracts, or conduct business.

Conclusion

Staying compliant with the NFP Act doesn't have to be complicated when you know what's required and when. The most critical deadline to remember is your annual return, which is due within 60 days of your anniversary date. Set calendar reminders for all your key deadlines to avoid late fees and compliance issues.

Important note: This article covers federal obligations under the Canada Not-for-Profit Corporations Act. If your organization is provincially incorporated (for example, under Ontario's ONCA), different rules apply. Check your incorporating documents to confirm whether you're federally or provincially incorporated.

If you require expedited nonprofit or charity registration, or need assistance with annual compliance filings, the experienced lawyers at B.I.G. Charity Law Group Professional Corporation can help. Just click on the link above to schedule a free phone call with our team and get started. Join our thousands of clients in Ontario, including from Toronto, Markham, Mississauga, Ottawa, Hamilton, and Barrie, as well as clients from across all provinces and territories in Canada, who we've successfully helped register their nonprofit and/or charity quickly, affordably, and easily.

Frequently Asked Questions

Not-for-profit corporations in Canada have several specific reporting and filing duties each year.

These include submitting annual returns, updating records, holding meetings, and managing financial reports in line with federal rules.

What are the requirements for annual shareholder meetings in Canada?

Not-for-profit organizations must hold annual members’ meetings to review financial statements and approve important decisions.

Members must receive adequate notice before the meeting, and the agenda should include the financial report and any voting on major changes.

What are the requirements for soliciting corporations under the Canada Not-for-Profit Corporation Act?

Soliciting corporations must submit financial statements and an accountant’s report at least 21 days before their annual members’ meeting.

These documents must be filed online with Corporations Canada to show transparency when raising funds from the public.

What are the audit requirements for nonprofits in Canada?

Not all nonprofits are required to have a full audit.

Larger organizations or those that solicit funds may need their financial statements reviewed or audited by an independent accountant. The requirement depends on the corporation’s size and activities.

What are the requirements for audit in Canada?

Audits must be performed by qualified professionals and comply with generally accepted auditing standards.

The audit verifies the accuracy of financial statements and helps ensure the nonprofit’s financial information is reliable and transparent for members and regulatory bodies.

What consequences does a not-for-profit face for non-compliance with annual obligations?

Failure to file annual returns, tax returns, or update required information can lead to serious penalties. These penalties may include the dissolution of the corporation.

Dissolution stops the organization from operating legally. It may also cause loss of assets or revocation of charitable status if applicable.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)